utah state solar tax credit 2020

Find The Best Option. 12 Credit for Increasing Research Activities in Utah.

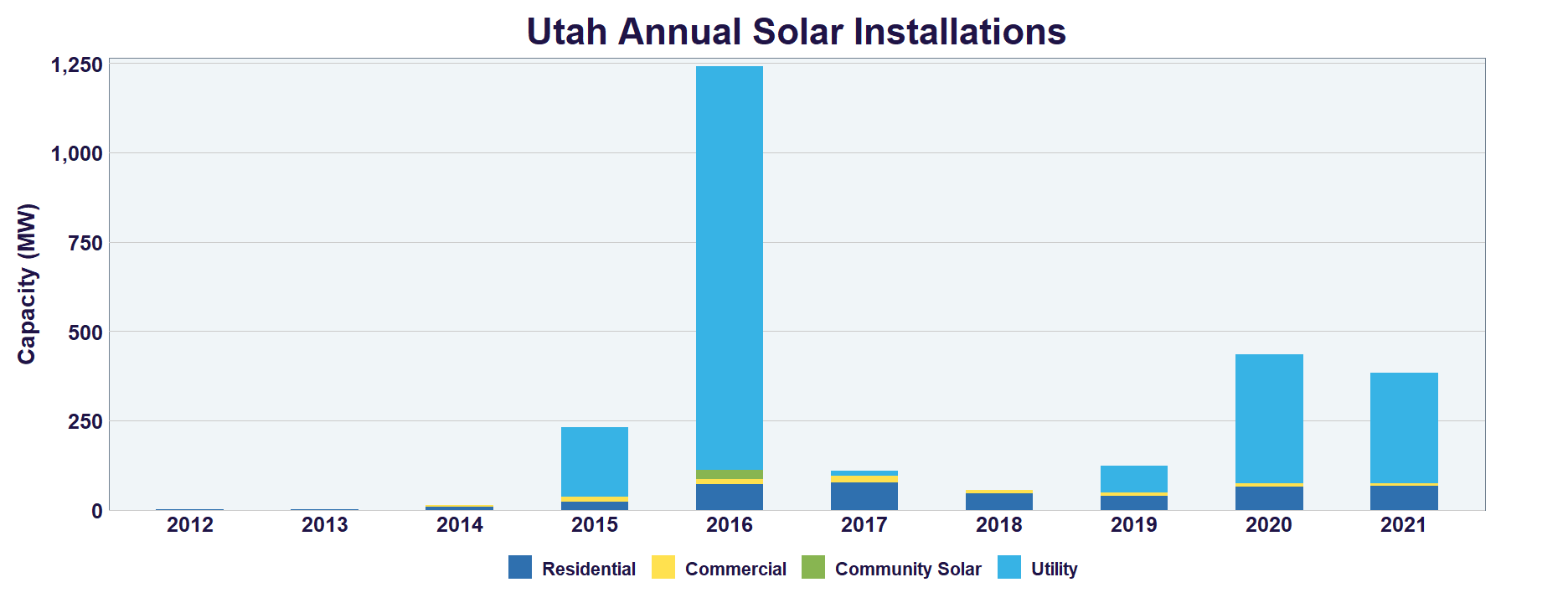

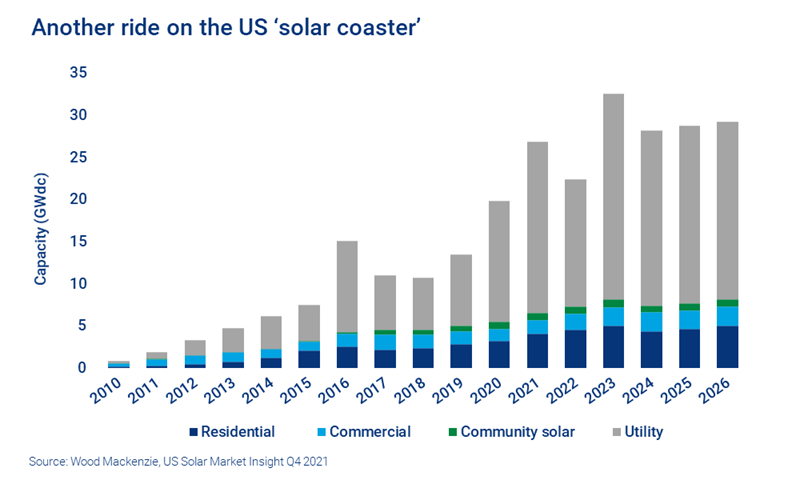

Redefining The Us Solar Coaster Wood Mackenzie

Check 2022 Top Rated Solar Incentives in Utah.

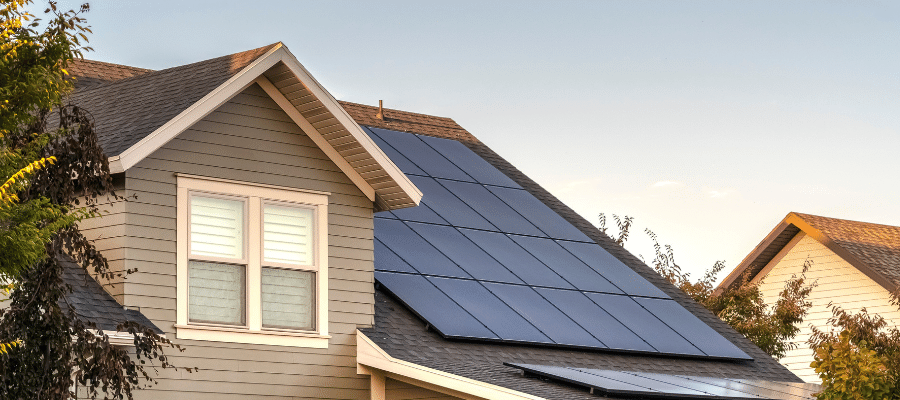

. But that sun also makes Utah an ideal state for solar energy development. Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations.

Check Rebates Incentives. Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array. The Utah Public Service Commission agreed Friday to let Rocky Mountain Power reduce the amount of energy.

Offer helpful instructions and related details about Utah Solar Energy Credit 2020 - make it easier for users to find business information than ever. Ad A Comparison List Of Top Solar Power Companies Side By Side. 17 Credit for.

In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. Under the Amount column write in 2000 a.

31 2020 500 am. Enter Your Zip See If You Qualify. So while there is a state solar tax credit in Utah there are no solar energy rebates or solar sales tax exemptions here.

Ad Enter Your Zip Code - Get Qualified Instantly. Check Rebates Incentives. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is.

We are accepting applications for the tax credit programs listed below. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit.

Utahs RESTC program is set to expire in 2025. If you install your photovoltaic system in 2020 the federal tax credit is. Commercial Tax Credits for Infrastructure and.

Is a post-performance non. 350 North State Suite 350 PO Box 145030 Salt Lake City Utah 84114 Telephone. 2022s Top Solar Power Companies.

Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014. By Sara Tabin. Enter Your Zip See If You Qualify.

By Tracy Fosterling on Mar 28 2018. From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower. The process to claim the Utah renewable energy tax credit is relatively simple and.

So when youre deciding on whether or not to. The bill extends the cap on the. Welcome to the Utah energy tax credit portal.

While the 25 of eligible solar system costs will. Read User Reviews See Our 1 Pick. Ad Step 1 - Enter ZipCode for the Best Powerhome Solar Pricing Now.

These are the solar rebates and solar tax credits currently available in Utah according to the Database of State Incentives for Renewable Energy website. Ad Enter Your Zip Code - Get Qualified Instantly. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less.

This credit is for reasonable costs including installation of a residential energy system that supplies energy to a. And because of the climate it is among the sunniest states in the countrys solar belt. Johnsonite Moldings For Top.

Utahs solar tax credit makes going solar easy. Summary of Utah Low-Income Housing Tax Credit. Low Cost Powerhome Solar Options for Less - Hire the Right Pro Today and Save.

When customers purchase a system this state tax credit is. State Low-income Housing Tax. The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for.

Utah customers may also qualify for a state tax credit in addition to the federal credit. 08 Low-Income Housing Credit. Solar Tax Credits.

Ad Find Out What You Should Pay For Solar Panels Based On Recent Installs In Your ZIP Code. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. 2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

Check 2022 Top Rated Solar Incentives in Utah. Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at.

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

Research Shows Big Trees Boost Water In Forests By Protecting Snowpack

Us Solar Fund Acquires Milford Solar Project In Utah

2022 Massachusetts Solar Incentives Tax Credits

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Solar Panel Efficiency Matters But Not As Much As You Think Iws

Swell Energy Sonnen Turn Household Solar Storage Into Grid Assets In California And Utah Energy Storage News

Does Solar Make Sense In Utah Smart Energy Usa

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Us Solar Hits Some Bumps In The Road Wood Mackenzie

8 Costly Solar Mistakes To Avoid When Designing Your Home Solar System S Coulee Limited

Palmetto Expands To Utah Pv Magazine Usa

2022 Massachusetts Solar Incentives Tax Credits

Utah Solar Utah State Incentives Prices Savings

Utah Solar Utah State Incentives Prices Savings

Redefining The Us Solar Coaster Wood Mackenzie

Us Energy Storage Developers Plan 9 Gw In 2022 Building On 2021 Breakthrough S P Global Market Intelligence

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar