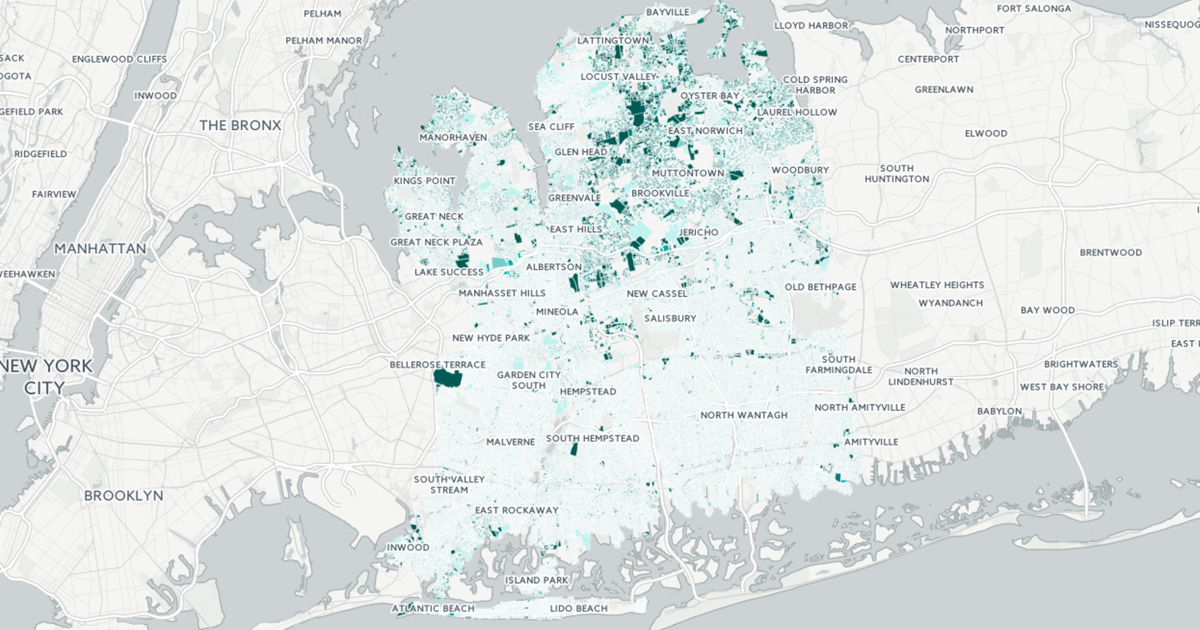

nassau county tax grievance status

Nassau county tax grievance status. If I file a tax grievance Nassau County tax officials will personally inspect my home.

333 Route 25A Suite 120 Rocky Point NY 11778 Suffolk County.

. 516 342-4849 email protected. We hope that youve filed your tax grievance as Nassau County is one of the highest. Subsequent references to a case in running text or within parentheses may use a shortened case name.

For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. March 2 property tax rates in new york especially in suffolk and nassau counties are among the highest. Its free to sign up and bid on jobs.

When Will My Assessment. Nassau county legislator joshua lafazan woodbury is partnering with the nassau county assessment review commission to host a pair of online tax grievance workshops. At the request of Nassau County Executive Bruce A.

The property you entered is. All Live ARC Community. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners.

We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. ARCNassauCountyNYgov Welcome to AROW Assessment Review on the Web.

240 Old Country Road 5th Floor Mineola New York 11501. 631 302-1940 Nassau County. After three extensions Nassau Countys 20202021 tax grievance filing deadline has finally passed.

Your Friendly Neighborhood Property Tax Reducer. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair. Appeal your property taxes.

The complete tax grievance process usually takes from 9 to 24 months. Click to request a tax grievance authorization form now. LOWER YOUR PROPERTY TAXES WITH.

Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is. Maidenbaum can help lower property taxes in Nassau County Long Island. Petition to lower property taxes.

The method that Nassau County and other local tax authorities in New York State use to. 631 302-1940 Nassau County. Nassau county tax grievance status Saturday June 11 2022 Edit.

How To File A Tax Assessment Grievance In Nassau County Hilary Topper Blog

Reliance Property Tax Grievance Services Bellmore Ny Nextdoor

Property Tax Grievance The Heller Clausen Grievance Group Llc Homepage Property Tax Grievance The Heller Clausen Grievance Group Llc

5 Myths Of The Nassau County Property Tax Grievance Process

News Flash Nassau County Ny Civicengage

All Sides Agree Grieve Your Nassau Tax Assessment Updated

How To Grieve Your Nassau County Property Taxes Youtube

Nassau County Property Tax Grievance Realty Tax Challenge

How Property Tax Grievance Works Aventine Properties

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County New York Grievance Period Extended

Tax Certiorari Master Petition 2018 19 Master 1195 Little Neck April 20 2018 Trellis

How Parasites Poison Nyc Suburbs Property Tax System

Gonsalves Hosts Property Tax Grievance Forum East Meadow Ny Patch

Pravato To Host Free Property Tax Assessment Grievance Workshop Town Of Oyster Bay

Curran Makes Changes To Nassau S Crippled Assessment System Long Island Business News